CA Elevate Wellness Center Insurance Verification Form 2008-2024 free printable template

Show details

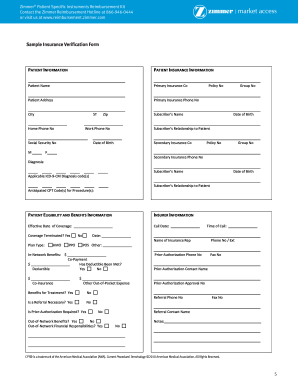

Insurance Verification Form Patient Name: Patient DOB: Patient Address: City: Zip: Insured's Name: Insured's SSN: Insured's ID#: Doctor's Office: Melinda Chop, Lac Group#: Referring Dr.: Ins. Co.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your insurance verification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance verification form online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance verification form pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out insurance verification form

How to fill out insurance verification form:

01

Gather all necessary information and documents such as policy number, insurance company details, and the form itself.

02

Carefully read and understand the instructions provided with the form.

03

Start by entering your personal information, including your name, contact details, and date of birth.

04

Provide accurate details about the insurance policy you are verifying, such as the policyholder's name, policy number, and effective dates.

05

Fill out any additional sections on the form that require specific information, such as coverage limits or specific details about the insured property or vehicle.

06

Verify and double-check all the information you have entered to ensure accuracy.

07

If required, attach any supporting documents that may be necessary for the verification process, such as insurance certificates or ID cards.

08

Review the completed form one final time to ensure all information is accurate and complete, and make any necessary corrections or additions.

09

Sign and date the form as required.

10

Submit the completed form to the appropriate recipient, such as your employer or the requesting party.

Who needs insurance verification form:

01

Individuals or entities requiring proof of insurance coverage, such as employers, landlords, or government agencies, may request an insurance verification form.

02

Insurance companies may also require policyholders to fill out a verification form to ensure accurate and up-to-date information is recorded.

03

Additionally, individuals who have recently purchased a new insurance policy may need to provide a completed verification form to the appropriate parties to demonstrate coverage.

Fill health insurance verification form template : Try Risk Free

People Also Ask about insurance verification form

What does insurance verification mean?

Is verifying insurance hard?

What are the questions needed to be asked for insurance verification?

What methods are used to verify health insurance?

What is the insurance verification process?

How is insurance verification done?

Is insurance verification the same as prior authorization?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance verification form?

An insurance verification form is a document that is used by health care providers to verify the insurance coverage of a patient. It is typically completed by the patient’s insurance company and sent to the provider. The form includes information such as the patient’s name, policy number, type of coverage, and the effective date of the policy. The form is used to ensure that the provider is reimbursed for the services they provide to the patient.

Who is required to file insurance verification form?

The patient is typically the one required to file an insurance verification form, as it is typically their responsibility to provide their insurance information to their healthcare provider.

What is the purpose of insurance verification form?

The purpose of an insurance verification form is to make sure that a person's insurance coverage is up-to-date and valid. It serves as a way to confirm the details of a person's insurance policy, including the type of coverage, the duration of the policy, and the premiums or deductible amounts associated with the policy. The form is typically used by healthcare providers, insurance companies, and other entities to ensure that an individual is covered for the services they are receiving or providing.

How to fill out insurance verification form?

Filling out an insurance verification form typically involves providing your personal and insurance information. Here are some general steps to follow:

1. Obtain the form: Either download the insurance verification form from the insurer's website or request a copy from your healthcare provider or insurance company.

2. Personal details: Enter your full name, address, phone number, email address, and date of birth accurately.

3. Policy information: Provide your insurance policy number, group number (if applicable), and the name of the insurance company.

4. Primary insured information: If you are not the primary policyholder, include the primary insured's name, relationship to you (e.g., spouse, parent), and their date of birth.

5. Coverage details: Indicate the type of insurance plan you have (e.g., health, dental) and specify the start and end dates of your coverage.

6. Signed consent: Review the consent section and sign it to authorize the release of your insurance information.

7. Additional documents: Attach any required documents, such as a copy of your insurance card, if requested.

8. Review and submission: Double-check all the entered information for accuracy before submitting the form. Ensure you have included all necessary details and attachments.

Keep in mind that the specific requirements may vary depending on the insurance provider or the purpose of the verification form. It is best to read the instructions provided with the form or contact the insurance company directly for any additional guidance.

What information must be reported on insurance verification form?

The specific information that must be reported on an insurance verification form may vary depending on the purpose and requirements of the form, as well as the policies of the organization or entity requesting the verification. However, generally, the following information is commonly requested:

1. Policyholder Information: The name, address, and contact details of the person or entity who holds the insurance policy.

2. Insured Individual Information: The name, date of birth, and relationship to the policyholder of the individual(s) covered under the insurance policy.

3. Insurance Carrier Information: The name, address, and contact details of the insurance company or organization providing the coverage.

4. Insurance Policy Details: The policy number, effective dates, and any relevant policy limits or coverage types.

5. Coverage Verification: Information regarding the type of coverage provided (such as health insurance, auto insurance, or property insurance), including any exclusions or limitations.

6. Provider Information: The name, address, and contact details of the healthcare provider, service provider, or organization requesting the insurance verification.

7. Authorization and Signature: The signature of the policyholder or authorized representative consenting to the release of insurance information.

It's important to note that this is a general list, and the specific requirements for an insurance verification form may differ depending on the purpose and requesting organization's needs.

What is the penalty for the late filing of insurance verification form?

The penalty for the late filing of an insurance verification form can vary depending on the specific circumstances and the applicable laws or regulations in your jurisdiction. In some cases, there may be financial penalties or fees associated with late filing, while in other cases, the penalty may result in a loss of coverage or certain benefits. It is advisable to consult with your insurance provider or regulatory agency to obtain accurate and up-to-date information on the specific penalties for late filing in your situation.

How can I edit insurance verification form from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including insurance verification form pdf, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get printable insurance verification form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the medical insurance verification form pdf in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit insurance verification form template on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing verification of benefits form.

Fill out your insurance verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Insurance Verification Form is not the form you're looking for?Search for another form here.

Keywords relevant to medical insurance verification form template

Related to insurance eligibility verification form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.